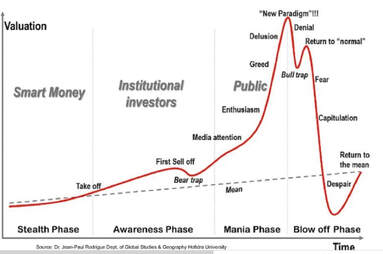

It’s hard to deny, although some do, that the stock market, pre-coronavirus, was pushing the limits of what it means to be in a bubble. Of course, bubbles come and go, but as Hofstra University’s Jean-Paul Rodrigue suggests, this one had a particularly fierce tailwind. “Although manias and bubbles have taken place many times before in history...” he once wrote, “central banks appear to make matters worse by providing too much credit and being unable or unwilling to stop the process with things are getting out of control.” Rodrigue explained that bubbles unfold in stages, an observation backed by 500 years of economic history. “Each mania is obviously different,” he said. “But there are always similarities.” His concept of the bubble has been passed around finance circles for years. Most recently, John Hussman of Hussman Investment Trust used Rodrigue’s chart to warn investors of what’s to come: Read more...

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorThe mission of EDAC is to connect budding & existing entrepreneurs to resources for venture management & growth. Archives

July 2024

Categories

All

|

Proudly powered by Weebly

RSS Feed

RSS Feed